'

'

'

'

At MP Investment and Financial Services Company, we empower you to achieve your financial goals through smart and informed investments in mutual funds. Whether you're planning for retirement, saving for your child's education, or looking to grow your wealth, our expertly curated mutual fund portfolios offer you the opportunity to invest in diverse assets and maximize your returns.

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds provide individual investors access to a broader range of investments than they might be able to afford on their own

When you invest in a mutual fund, you buy shares of the fund, which represent a small portion of the fund’s total portfolio. This allows you to benefit from the fund’s overall performance, giving you exposure to multiple asset classes with a single investment.

Mutual funds work by pooling the money of multiple investors into a single fund managed by professional fund managers. Here’s how the process works:

Equity mutual funds invest primarily in stocks or equities of publicly listed companies. These funds typically offer higher returns but also come with higher risk due to market volatility. They are ideal for investors with a long-term investment horizon and a higher risk tolerance.

Debt mutual funds invest in fixed-income securities such as government bonds, corporate bonds, and other debt instruments. These funds are less volatile and provide regular income, making them suitable for conservative investors who prioritize stability and lower risk.

Hybrid funds combine both equity and debt instruments in a single portfolio, providing a balanced mix of growth and stability. These funds are suitable for investors who want a diversified approach to investing, offering both potential capital appreciation and regular income.

Index funds track a specific market index (e.g., Nifty 50, S&P 500). These funds typically have lower management fees and aim to replicate the performance of the index they follow, offering broad market exposure. They are passive investment options suitable for investors seeking market returns with minimal fees.

Sectoral funds invest in specific sectors such as technology, healthcare, energy, or infrastructure. These funds are more concentrated and can offer higher returns, but they are also riskier due to their lack of diversification. These funds are ideal for investors who have a strong belief in the growth potential of a particular sector.

Liquid funds primarily invest in short-term money market instruments such as Treasury bills, certificates of deposit, and repurchase agreements. These funds offer high liquidity and low risk, making them ideal for parking short-term funds.

Investing in mutual funds can offer several advantages, making them an appealing option for many investors. Here are some of the key reasons to consider investing in mutual funds:

Mutual funds allow you to invest in a wide range of assets, spreading your investment across various sectors, industries, and geographies. Diversification helps reduce the impact of any single asset’s poor performance on your overall investment.

With mutual funds, your investments are managed by professional fund managers with in-depth market knowledge. They make informed decisions, continually monitoring market trends to ensure your investments are well-positioned for growth.

Mutual funds are highly liquid. This means you can easily buy and sell units of the fund at any time, typically at the end of the trading day, based on the Net Asset Value (NAV) of the fund.

Most mutual funds have relatively low minimum investment requirements, making them an affordable option for all types of investors, regardless of their capital size.

Mutual funds provide detailed reports and insights about the portfolio, performance, and investment strategy, ensuring transparency for investors. You can track your investment’s progress at any time through online portals or by receiving regular statements.

Whether you're looking for a safe, steady return or are willing to take on more risk for potentially higher returns, there’s a mutual fund suited to your risk profile, financial goals, and investment horizon.

At MP INVESTMENT AND FINANCIAL SERVICES COMPANY , we provide expertly crafted mutual fund portfolios tailored to your unique financial goals. Here’s how we ensure you benefit from investing with us:

Our team of experts will work with you to assess your risk profile, financial goals, and investment horizon. Based on your needs, we’ll recommend a portfolio that aligns with your preferences.

We constantly monitor the performance of your investments, adjusting the portfolio to ensure that it stays aligned with the market trends and your long-term objectives. You’ll receive regular updates and reports, keeping you informed at all times.

We believe in complete transparency. Our pricing model is straightforward, with no hidden fees. You’ll know exactly what you’re paying for and what to expect from your investments.

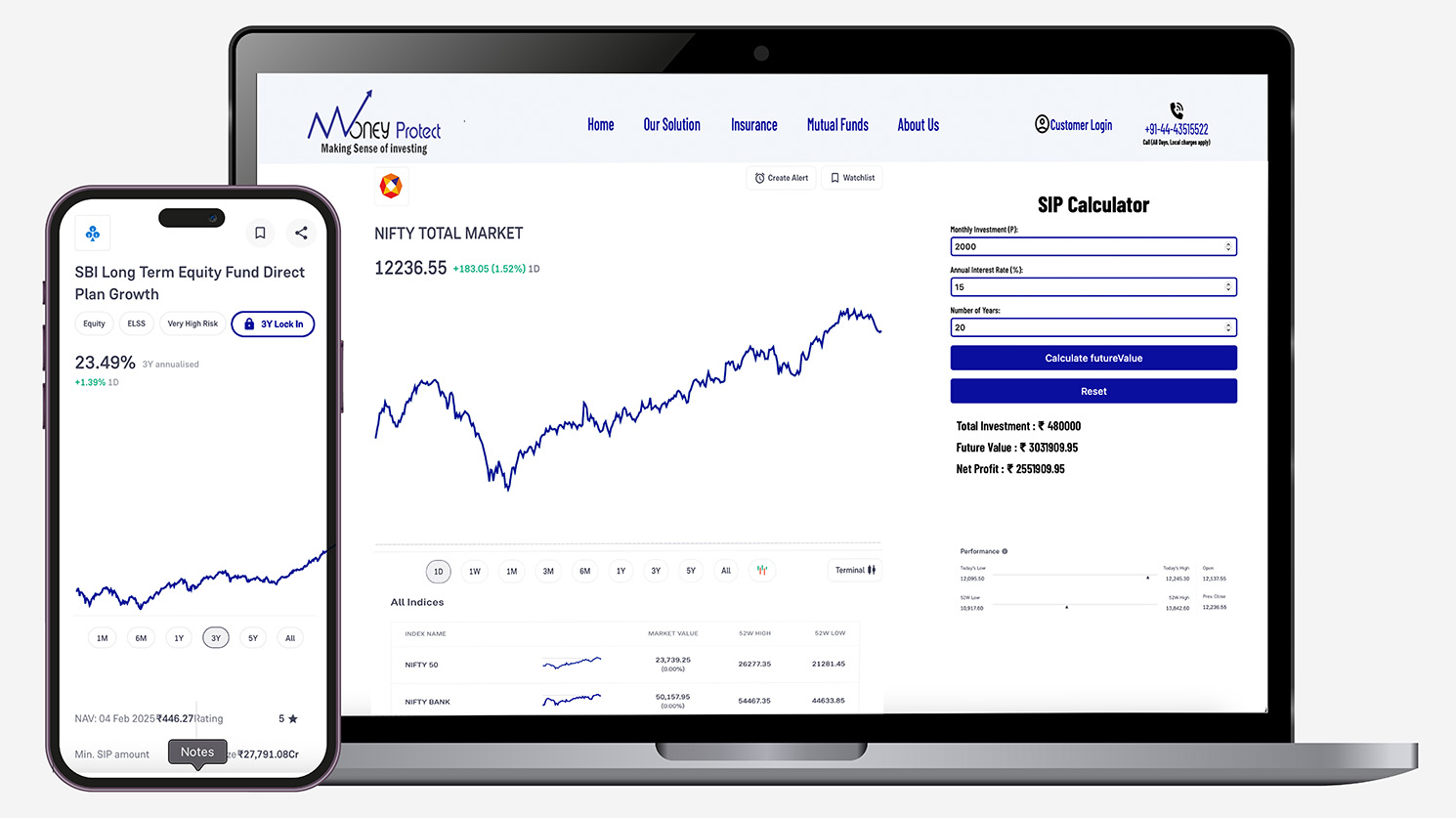

Investing in mutual funds with [Your Brand Name] is easy, with an intuitive online platform that allows you to track and manage your investments at your convenience. Plus, our customer service team is always ready to assist you whenever needed.

We provide access to a wide range of mutual fund categories, helping you build a diversified portfolio that balances risk and potential reward, tailored to your needs and goals.

Have questions about mutual fund investments? Our team of experts is here to help. Request a callback today, and we'll guide you through the process and answer any questions you may have.

Mutual funds are a powerful investment tool that offers diversification, professional management, and flexibility—all with relatively low investment barriers. Whether you're looking to grow your wealth, save for a specific goal, or create a diversified portfolio, mutual funds can help you achieve your financial objectives. At MP INVESTMENT AND FINANCIAL SERVICES, we are committed to helping you invest smarter and live better. Let us guide you on your investment journey with customized solutions and expert insights. Start your investment journey today and unlock the potential of mutual funds with MP INVESTMENT AND FINANCIAL SERVICES.

No 1/269, Kalamegam Salai

Mugappair West, Chennai - 600037

Tamilnadu - India

044 - 43515522

Monday - Saturday: 9:30 AM - 6:30 PM

Sunday: Holiday